Latest Fluctuo’s European Shared Mobility Q3 Index shows Paris embracing dockless bikes following scooter ban

Fluctuo, the leading aggregator of shared mobility data, has unveiled its newest Q3 2023 European Shared Mobility Index (ESMI).

The report, supported by industry giants including Arval, Drover, PBSC, Segway, SHARE NOW, and POLIS, sheds light on the evolving landscape of shared mobility in Europe. Following Fluctuo's Q1 2023 ESMI, which revealed continued growth in the face of economic challenges, and Q1 2023 ESMI, which highlighted a shift from scooters to bikes, the latest report once more shows a decrease in moped and scooter trips, signalling the rapid shifting mobility landscape, brought on by financial and regulatory challenges.

Dockless Bikes Across Europe: A 44% Surge in Q3 2023

According to Fluctuo's latest report, dockless bike ridership across Europe experienced a substantial 44% increase in Q3 2023. The growth is accompanied by a 12% expansion in dockless bike fleets since the previous year, bringing the total count to 90,000. This nearly matches the 100,000 station-based bikes distributed across the 33 cities considered in the report.

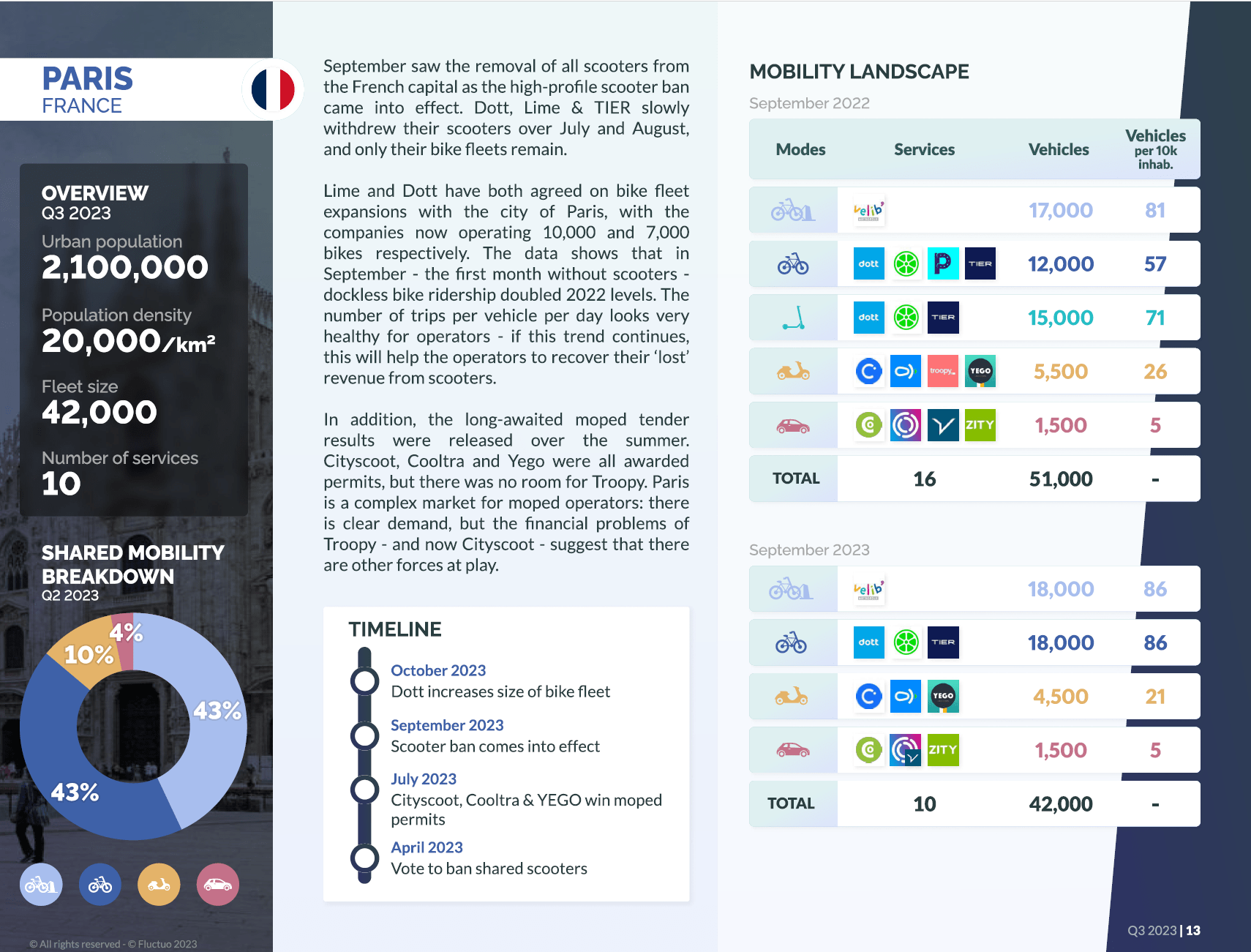

Paris, in particular, has witnessed a doubling of dockless bike ridership in September 2023, marking the first month of the French capital's e-scooter ban. With 1.4 million trips, Paris ranks second for the average number of trips taken per month by dockless bikes in Q3 2023. Notably, scooters saw a 14% reduction in ridership across Europe since the previous year.

Julien Chamussy emphasised the proactive stance of Paris towards reducing private car use, despite recent scooter bans. Operators such as Dott, Lime, and Tier were asked to remove all scooters by the end of August but were simultaneously encouraged to focus on dockless bikes.

Shared Car Ridership Grows by 22%

Surprisingly, the report also highlights the continued growth of shared car fleets and their ridership, growing by 22% over the last 12 months. German cities, specifically Berlin and Hamburg, lead the charts with the highest average trips per month at 600,000 and 350,000 trips, respectively. Madrid follows closely, ranking third for shared car trips at 325,000 per month.

Talking to Zag Daily, Julien Chamussy expressed his surprise at the shared car segment's robust growth, attributing the success to the increasing demand and the implementation of incentives, such as free parking for shared electric cars in Madrid and elevated parking fees for private car parking in city centres.

A look at Brussels

Q3 also features a case study on Brussels — the city, grappling with an oversaturation of shared scooters (it boasts a whopping 20,000 scooters operated by nine different companies), is implementing measures to address the challenges posed by the many two-wheelers on its streets.

Q3 also features a case study on Brussels — the city, grappling with an oversaturation of shared scooters (it boasts a whopping 20,000 scooters operated by nine different companies), is implementing measures to address the challenges posed by the many two-wheelers on its streets.

Anticipating the need for regulation, Brussels has been awaiting the implementation of legislation to manage the number of scooter operators. This legislation came into effect in 2023, prompting the city to initiate a tender in July. The goal is to select two scooter operators, each permitted to manage a fleet of 4,000 vehicles.

With the removal of 12,000 scooters from circulation, Brussels envisions a shift in mobility preferences, anticipating increased demand for bikes, cargo bikes, and mopeds. While the city currently has five dockless bike operators, few operate on a scale conducive to profitability. The tender aims to choose three operators to collectively manage 7,500 dockless bikes, introducing a new dynamic to Brussels' evolving mobility ecosystem. Additionally, two fleets of cargo bikes will be integrated into the city's transportation options.

In the moped segment, the tender seeks to award permits to two operators, each authorised to operate 300 vehicles. Presently, only one company is active in Brussels due to the oversaturation of vehicles, but the hope is that the tender will attract a second moped company, providing users with an additional option and contributing to the city's economic viability.

About Fluctuo

Fluctuo is a leader in mobility enablement, providing operators and cities with comprehensive and accurate shared mobility data. Founded in 2019, the company quickly established itself as a trusted partner for shared mobility and public transport companies, MaaS providers, and cities. Fluctuo's goal is to offer to enable.

For more information on Q3 2023 European Shared Mobility Index, please contact Harry Maxwell at harry.maxwell@fluctuo.com.