The Game Has Changed: Rethinking Urban Freight

COVID-19 is hitting all aspects of our society, with the global economy experiencing its largest crisis in years [1]. Many industries, including urban freight have had to adjust their operations immediately to fit new demands says Philippe Rapin, CEO of Urban Radar. In the coming months, the supply chain industry and cities will need to withstand the current crisis and then look into ways to evolve and later seek opportunities in the urban supply chain.

Like any other industry, COVID-19 impacted urban freight very early during the crises. Supply chain industry professionals report in conversations that all activities slowed down dramatically for nearly two weeks when countries implemented stay-at-home rules.

Suppliers in the chain are temporarily ceasing production, and logistics providers can no longer transport goods as seamlessly, particularly across borders.

Very quickly, this disruption of the supply chain made authorities realise how supply of secondary goods is as critical as essential goods to ensure the continuity of vital activities. For example, a hospital needs masks and pumps (first necessities) but also equipment to fix the air conditioning, elevators or building lifecycle items required to operate. During containment measures to slow down the spread of COVID-19, logistics have so far been the backbone of our success in ensuring essential supplies reach customers. General Dwight D. Eisenhower said “You will not find it difficult to prove that battles, campaigns and even wars have been won or lost primarily because of logistics."

At the global level, the World Economic Forum reports that suppliers in the chain are temporarily ceasing production, and logistics providers can no longer transport goods as seamlessly, particularly across borders. Fiat Chrysler Automobiles announced in mid-February that it was temporarily halting production at a car factory in Serbia because it could not get parts from China. [2]

At the European level, the Supply Chain Recovery Index prepared by Shippeo [3] shows some dramatic declines in their supply chain activities including an astonishing 7% of normal activity within the space of 3 weeks for the Automotive & Transport manufacturing. Meanwhile, grocery stores and supermarkets have remained open throughout lockdown periods, with retailers able to quickly adapt their operations to guarantee safety of staff and shoppers while in store. Freight companies have had to quickly readapt routes to meet the unexpected inventory product variations and storage capacities. From April 14th, some signs of recovery were noticeable. .

Adapting to the COVID era: supply chains need to adapt and the pandemic has been accelerating the trend.

At the local level, grocery stores need constant restocking because they do not have sufficient space to hold stock. Online grocery stores have seen an increase in orders in the US (RBC Research [4]). The study also found that over the first weeks of April, 42% of respondents purchased groceries online at least once a week, up from 22% in 2018. To the contrary, deliveries to restaurants stopped all at once with limited recovery so far. E-commerce sales rose dramatically in March, with a 74% growth in average transaction volumes compared with the same period last year, according to data (ACI Worldwide [5]) Retailers are facing unusual circumstances for their online orders from either lack of demand or online seasonal peak demand from customers.

In addition to the online ordering frenzy, customer expectations are shifting to shorter delivery deadlines. That means that the location of the supplier needs to be as close as possible to the recipient. Overall, supply chains need to adapt and the pandemic has been accelerating the trend. With a mission to develop new and innovative logistics and supply chain concepts and innovation for a more competitive and sustainable industry, Fernando Liesa, the Secretary General of ALICE – Alliance for Logistics Innovation through Collaboration in Europe, indicates that the unusual lack of congestion and easier access to parking is reducing transport time in between deliveries making the process much more efficient.

However, this is likely to come to an end when cities reopen since there is a consensus to expect more private cars than before because public transportation ridership will be halved by more than 50% to ensure social distancing. Authorities need to mitigate the impact of these on quality of life, congestion and climate in the next 6 to 18 months while companies may need to find solutions to cope with the surge in demand in congested cities scenario.

Medium Term: Urban supply chains will need to innovate to meet business demand

COVID-19 is accelerating the supply chain industry innovation cycles. For example, Frederic Delaval the CEO of Urby and Director of the Urban Logistic program of Le Groupe La Poste indicates that the pandemic is accelerating the adoption of innovation such as digital signature to avoid contact during private home deliveries or new health procedures when checking large deliveries for groceries or retailers. We are facing a multidimensional scenario with variables ranging from health to individual psychology to economic recovery and political decisions.

Two majors factors provide indications about the direction the urban supply chain can take in the medium term. New consumption behaviours profoundly change the role urban logistics has in the way cities operate. Taking online grocery as an example of people’s behaviour indicator, the RBC’s study said the pandemic has “created an inflection point for online grocery shopping.”

Increased speed of delivery expected by customers, the new dynamics between retail, convenience store, ecommerce deliveries and the new need to locate storage of goods will also lead to continuous innovation

One-third of respondents said they made their first online grocery purchase in the past month. More than half of online grocery shoppers surveyed said COVID-19 is “leading them to permanently boost their willingness to buy groceries online.”

It is too soon to understand the new individual mobility patterns. So many factors are at play such as public transportation ridership, work-from-home patterns, etc. In a nutshell, are we going back to a world of intense mobility which is the source of congestion from private cars? Understanding and acting on these two latter issues is essential for our cities to rebuild economies, ensure health safety and maintain their climate agenda through low emission zones for example. To accommodate these new behaviours, cities will certainly need to update their curb side parking management, update their traffic policies and regulations, identify real estate for urban logistics platforms, etc.

On the other side, the urban logistics industry needs to improve its efficiency, find new business models to minimise the waste of empty loads for pick up or delivery of goods, but also work with cities to identify how it can have space in the public domain to perform its vital functions. It is unlikely that we will have a response to these before the end of summer and as European countries open up and before we have a vaccine, we are at risk of a second COVID wave. Looking ahead, better use of data is a powerful tool that the supply chain industry and the cities need to address their upcoming challenges.

Data-driven insights will help cities understand the changes of the urban logistics demands, will enable pattern analysis to support decisions for policy adjustment, investment decisions or enforcement implementation. Data-driven policies will provide the means to measure results, to adjust and to improve. Furthermore, advanced use of data analytics gives the unprecedented ability to cross reference supply chains with public transportation, congestion, air quality improvement and even social equity analysis.

Long Term: Opportunities for supply chain companies and cities leveraging data to deliver goods and services

There are two major individual lessons learnt from the past few months of stay-at-home rules:

- It is possible for all of us to live and stay at home

- We cannot live without access to goods and food

From a supply chain point of view, the question becomes: ‘do citizens need to access goods’ or ‘do goods need to find citizens’? Overall, COVID-19 makes us consider the value of the goods accessing the citizens rather than the other way around. Many initiatives already exist to plan for the future, including the Urban Logistics Roadmap that POLIS Network and ALICE have been working on together since 2014 [6].

Leveraging the use of public and private data seems to be a differentiator for survival and economic recovery in the next 12-18 months. The City of Versailles in France, in collaboration with the French supply chain industry (ASLOG), is running a pilot project to understand the urban logistics movement in the city and compare it with its parking infrastructure, its traffic policies, its congestion reports and the air quality index. With this information, the city is in a position to make data-driven decisions benefiting all stakeholders including their end users: the citizens.

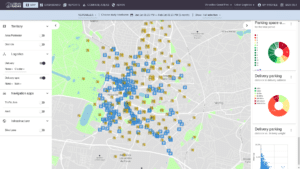

The goal is also to minimize the impact of urban deliveries in the cities (double parking creates congestion, commute duration, etc.) while acknowledging the increasing delivery volume requirements. Versailles has co-developed with the technology company Urban Radar a mobility analytics platform. With this technology, the city is for the first time able to see and understand the relationship between all these factors rapidly. The technology enables the city to maintain the data from each operator confidential while providing an aggregated picture to the city.

“From a supply chain point of view, the question becomes: ‘do citizens need to access goods’ or ‘do goods need to find citizens’?”

Thomas Bonhoure, the Director of Economic Development for Greater Versailles says : “Urban deliveries have been very much perceived as a challenge to tackle from both a public infrastructure management and congestion point of view. The COVID-19 crisis has unveiled the evidence that ‘cities need to be fed’ opening the way for a more collaborative approach between supply chain players and cities. This is the spirit of the partnership between Versailles and Urban Radar: how can we build a cooperative approach between all infrastructure users by sharing and analysing data. With the right data and levers we believe cities can reduce congestion and improve air quality.”

Conversely, by sharing securely and anonymously its data, the supply chain industry benefits from a better understanding by the authority of its usage of the public space. That leads to public decisions which contribute to increased delivery efficiency and favourable policies. Both the public and private sector also have now a data-driven base for discussion to build in partnership the future of urban logistics in the territory.

A New Age of Logistics

The increased speed of delivery expected by customers, the new dynamics between retail, convenience store, ecommerce deliveries and the new need to locate storage of goods will also lead to continuous innovation. Combined with the ongoing climate agenda, the need for electric powered deliveries will increase. This opens the topic of charging stations but also of dedicated infrastructures, multi-purpose parking, curb side pricing and maybe even dedicated lanes. The investments required to upgrade cities would benefit society, just like Versailles is aiming to do by using data driven decision making tools.

By developing such understanding by combining public and private data, cities and the industry will be able to explore new supply chain models such as mutualisation of pick-up and drop-off deliveries, creating rules of minimum deliveries required to enter into a district or set up a concession model whereby a handful of licensed operators are authorized to perform first/last kilomet deliveries within a defined geographic perimeter. Some of these concepts are nicely captured in the YouTube video “Physical Internet for sustainable city logistics and beyond” from ALICE.[8] COVID-19 is opening an opportunity to both the cities and the supply chain industry to start fresh and to experiment more efficient supply chain solutions. Cities and the supply chain industry agreeing to share data will be a game changer to the industry and will speed up our cities economic recovery.